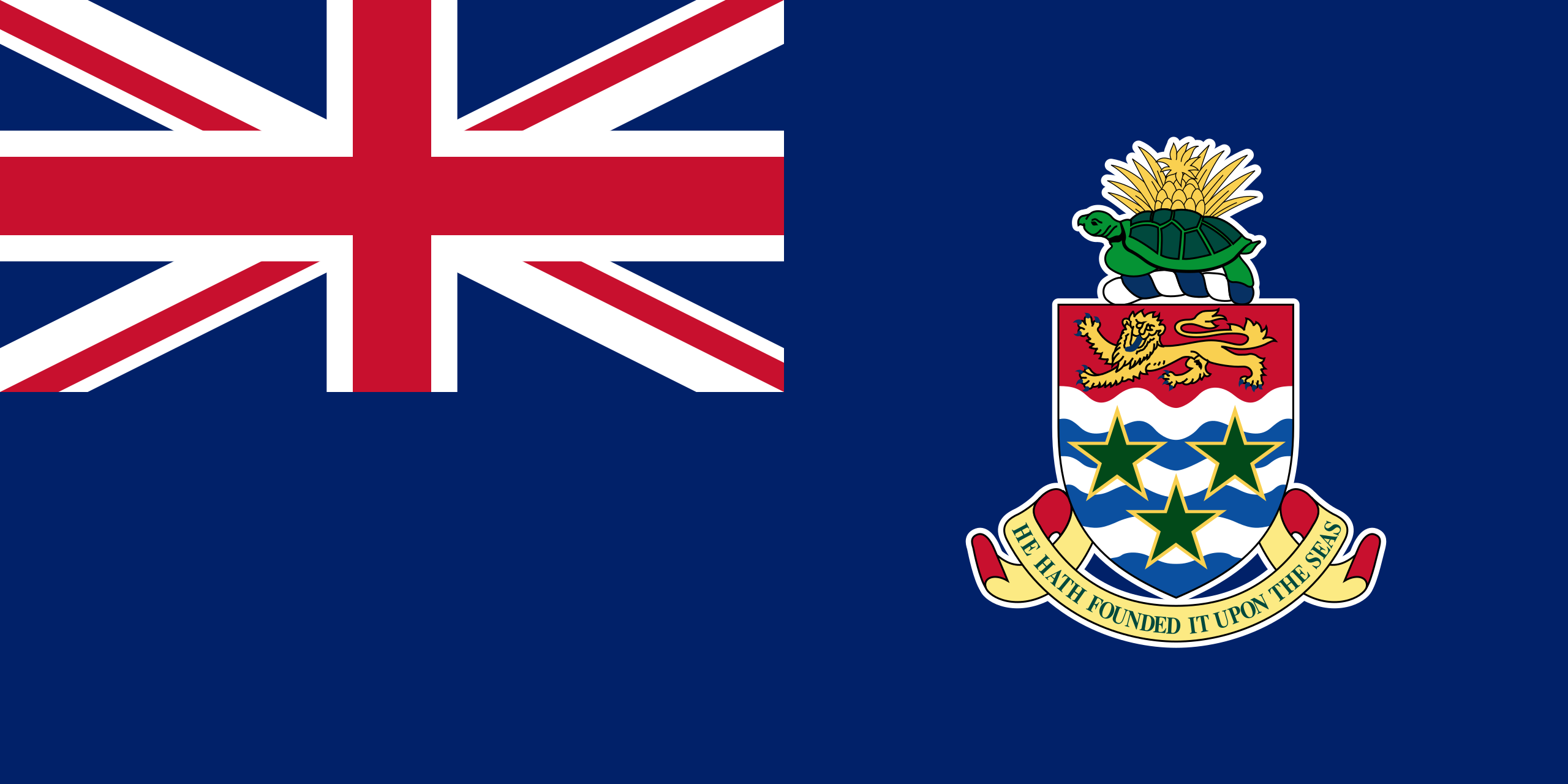

The Cayman Islands, a British Overseas Territory, has emerged as a prominent destination for establishing Virtual Asset Service Providers (VASPs). With its robust regulatory framework, favorable tax regime, and well-established financial infrastructure, the Cayman Islands offers an attractive environment for VASPs seeking to operate globally. The Cayman Islands Virtual Asset Service Providers Act, 2020 (VASP Act) establishes a comprehensive regulatory framework for VASPs operating within the jurisdiction. The VASP Act aims to combat financial crime, protect consumers, and promote market integrity while fostering innovation within the fintech sector.

Key advantages:

- Favorable Regulatory Environment: The Cayman Islands VASP Act provides a clear and well-defined regulatory framework, offering certainty and predictability for VASPs.

- Tax Advantages: The Cayman Islands 0% corporate tax rate and absence of capital gains tax make it an attractive location for VASPs seeking to minimize their tax liabilities.

- Strong Financial Infrastructure: The Cayman Islands boasts a well-established financial services sector with a deep pool of experienced professionals and a robust infrastructure to support VASP operations.

- Reputable Jurisdiction: The Cayman Islands enjoys a strong reputation as a leading financial center, providing VASPs with an internationally recognized and respected business address.

- Proximity to Key Markets: The Cayman Islands’ location in the Caribbean offers convenient access to major markets in North and South America.

- The Cayman Islands offers a variety of corporate structures to suit the needs of VASPs, including exempted companies, limited liability companies, and foundations.

- The jurisdiction has a strong legal framework that protects intellectual property.

Get in touch with us to learn more about becoming a VASP in Cayman Islands