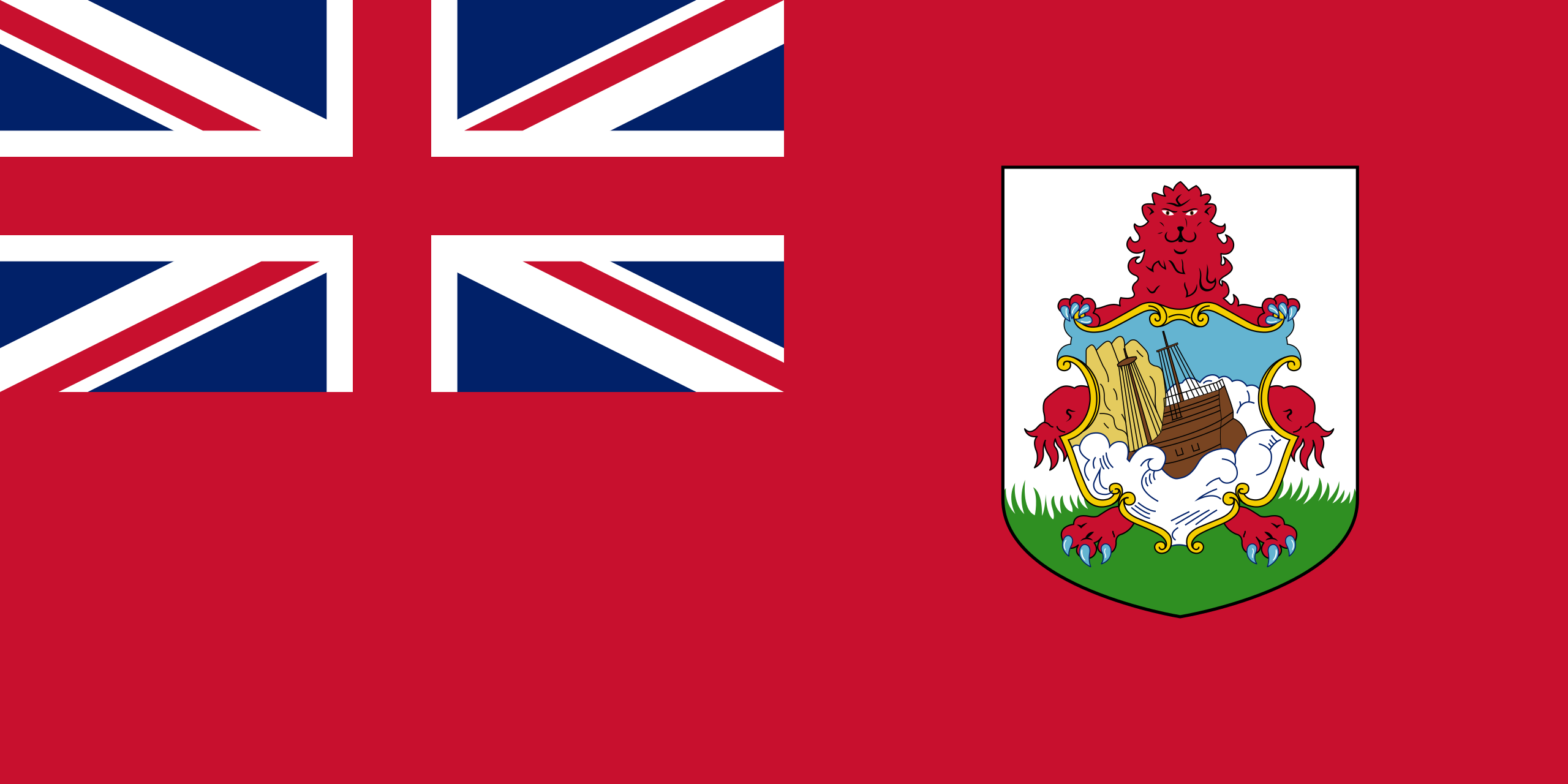

Bermuda’s progressive stance on digital assets has made it an attractive jurisdiction for VASPs, offering a supportive environment for blockchain and cryptocurrency businesses. With clear regulations and a commitment to transparency, Bermuda provides a stable and secure base for VASPs to thrive in the rapidly evolving digital asset landscape.

Key Advantages:

- Unparalleled Financial Reputation: Bermuda is globally recognized as a leading international financial center, consistently ranked among the world’s top offshore jurisdictions. Its reputation for integrity, transparency, and sound financial practices provides your VASP with an unparalleled foundation of trust and credibility.

- Attractive Tax Regime: Bermuda’s tax-friendly environment offers significant benefits for VASPs, including:

- No corporate income tax on profits generated from activities outside Bermuda

- No capital gains tax on the sale of assets, including virtual assets

- No withholding taxes on dividends, interest, or royalties paid to non-residents

- Tailored VASP Regulation: Bermuda’s Digital Asset Business Act 2018 (DABA) establishes a comprehensive and forward-thinking regulatory framework specifically designed for VASPs. This framework strikes a balance between fostering innovation while ensuring adherence to the highest standards of anti-money laundering (AML) and combating the financing of terrorism (CFT) measures.

- Responsive and Supportive Regulatory Authority: The Bermuda Monetary Authority (BMA) is the designated regulator for VASP activities in Bermuda. The BMA is known for its responsiveness, professionalism, and commitment to working closely with licensees to ensure compliance and facilitate growth.

- Access to a Global Network: Bermuda’s strategic location and well-established infrastructure provide VASPs with seamless access to global markets and a diverse network of financial institutions and business partners.

Get in touch with us to learn more about becoming a VASP in Bermuda