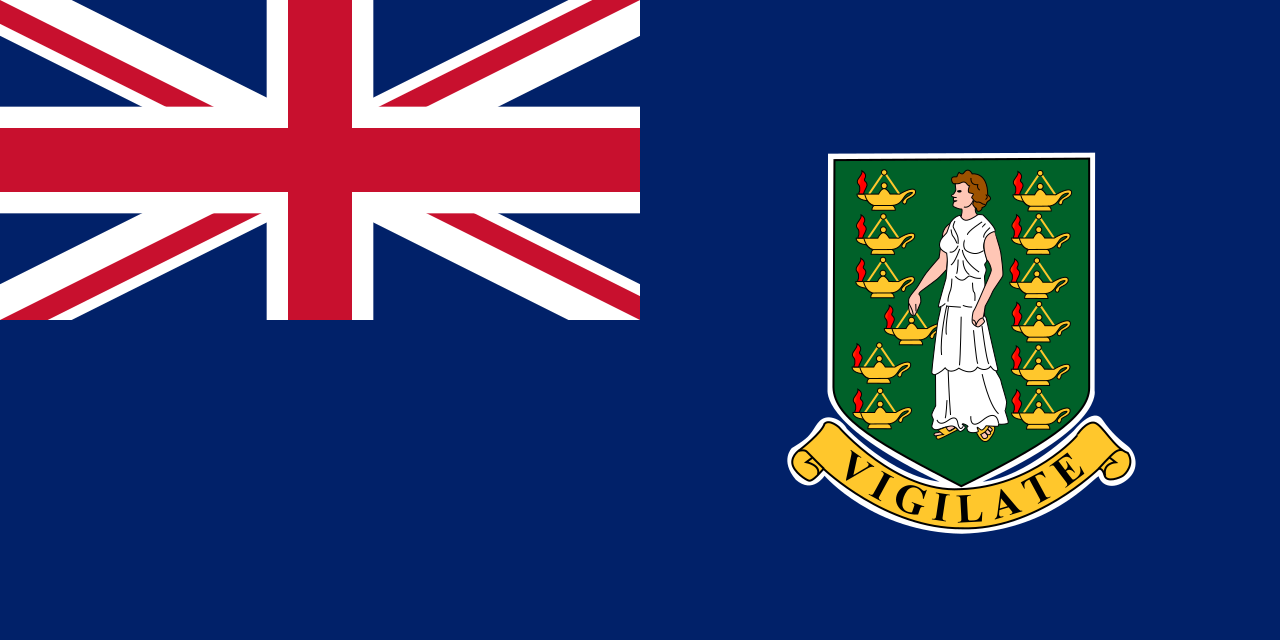

The British Virgin Islands (BVI) offers one of the most efficient and cost-effective offshore financial services frameworks in the world. Its International Business Companies (IBC) regime allows businesses to operate globally with tax exemptions and minimal reporting requirements. BVI’s IBCs are exempt from local taxes, including income tax, capital gains tax, and dividends tax, providing a tax-efficient environment for holding companies, asset protection, and international trading. Companies in the BVI benefit from low maintenance requirements, no mandatory annual meetings, and the ability to hold assets and conduct business internationally. The jurisdiction’s business-friendly environment, combined with its robust infrastructure and financial expertise, makes it a key destination for corporate structures such as holding companies, special-purpose vehicles (SPVs), and trusts. The territory’s close ties to the United Kingdom and its status as a British Overseas Territory provide additional credibility and stability.

Reach out to us to learn more about the benefits and opportunities of incorporating a company in the British Virgin Islands.