1. Favorable Tax Environment

- Gibraltar offers a highly competitive corporate tax rate of 12.5%, significantly boosting profitability for online gaming operators.

- Unlike some jurisdictions, Gibraltar levies no additional tax on gross gaming revenue, further enhancing your bottom line.

2. Strong Regulatory Framework

- Gibraltar Gambling Commission (GGC) is a well-respected regulatory body known for its focus on responsible gambling and player protection.

- The GGC provides clear and well-defined regulations, ensuring a predictable and stable operating environment.

- The licensing process for online gambling businesses in Gibraltar is known for its efficiency compared to some other jurisdictions.

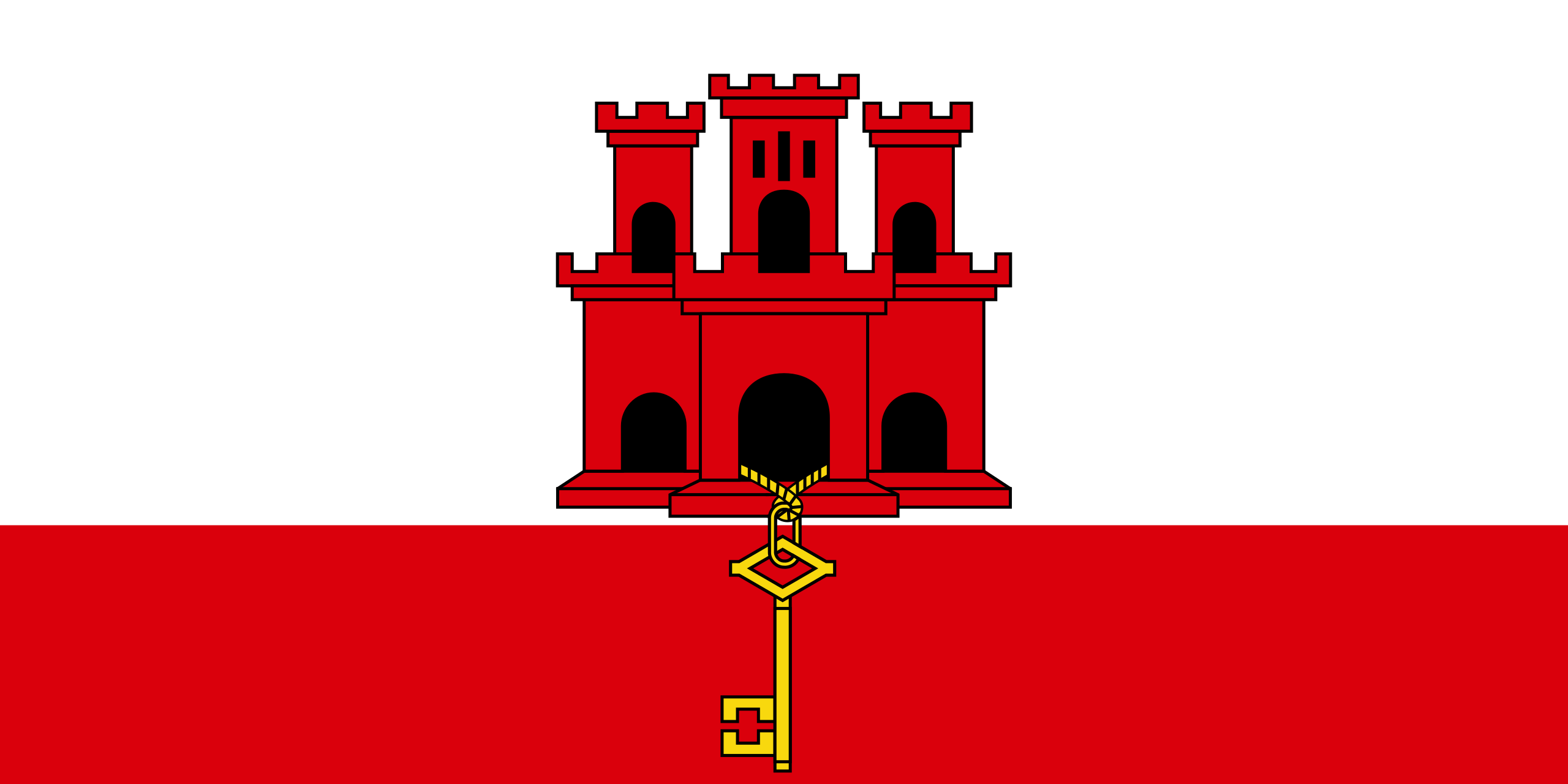

3. Long-Standing Reputation

- Gibraltar online gambling license is highly respected worldwide, demonstrating your commitment to responsible and secure gaming.

- Gibraltar has been a prominent player in the online gambling industry since the early 2000s, offering a wealth of experience and established infrastructure.

- Gibraltar offers a skilled workforce specializing in online gaming operations resides in Gibraltar, facilitating recruitment and talent acquisition.

4. Additional Considerations

- The online gambling market in Gibraltar is well-established, with strong competition from existing operators.

- Gibraltar’s domestic market is small, and targeting a wider audience might require additional licensing depending on your goals.

Get in touch with us to learn more about heaving a gaming license in Gibraltar