Seychelles is an ideal jurisdiction for entrepreneurs and businesses seeking offshore company registration. With a well-established regulatory framework, Seychelles supports the formation of International Business Companies (IBCs), which provide legal protection, tax advantages, and operational efficiency for global businesses.

The country’s offshore sector plays a crucial role in its economy, attracting foreign direct investment by offering tax exemptions, no exchange controls, and simplified reporting requirements for IBCs. With zero corporate tax for offshore companies, Seychelles provides an excellent environment for businesses looking to minimize their tax liabilities while maintaining compliance with international standards.

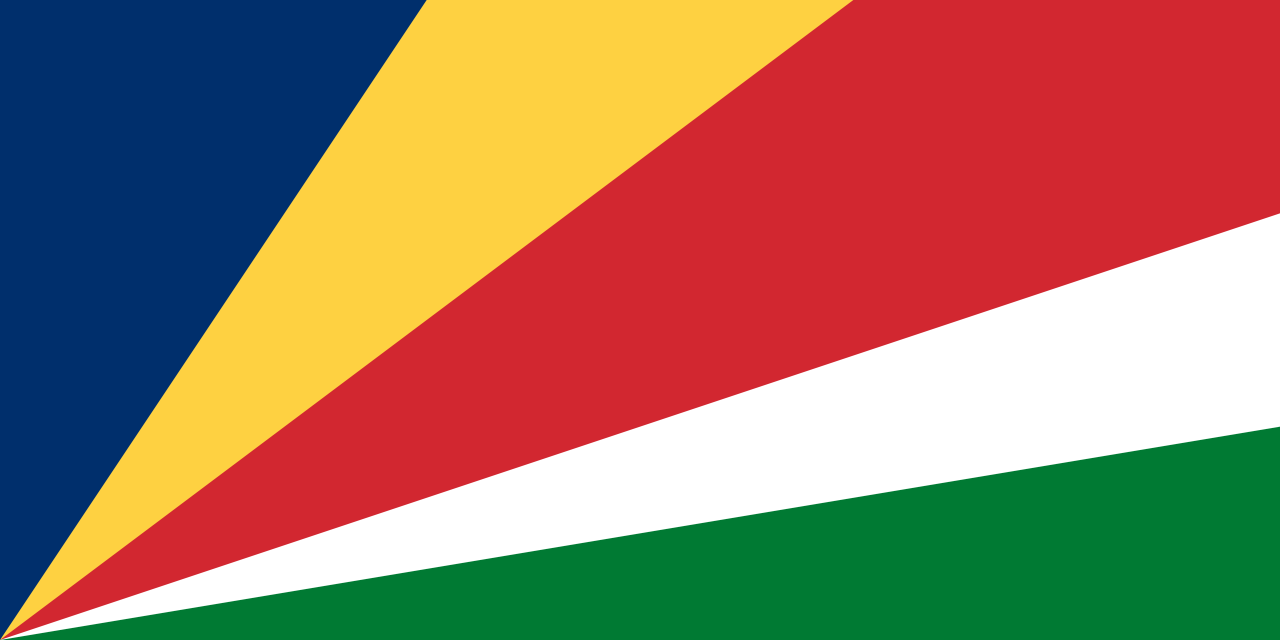

Seychelles transitioned from a colonial economy focused on agriculture to a modern service-oriented economy after gaining independence in 1976. The government’s proactive approach to economic reform and the establishment of a robust offshore sector has positioned Seychelles as a global hub for business incorporation. Its legal system is based on English common law, providing a solid foundation for the protection of business interests and ensuring a secure operating environment for international companies. Seychelles is strategically located in the Indian Ocean, providing access to key markets in Africa, Asia, and the Middle East. The country’s neutral stance in global politics and its membership in international organizations like the African Union (AU) and the Indian Ocean Commission (IOC) enhance its appeal as a safe and reliable base for international business. Seychelles also has a wide network of double taxation avoidance treaties, offering businesses additional tax planning advantages.

Reach out to us to learn more about the benefits and opportunities of incorporating a company in Seychelles.