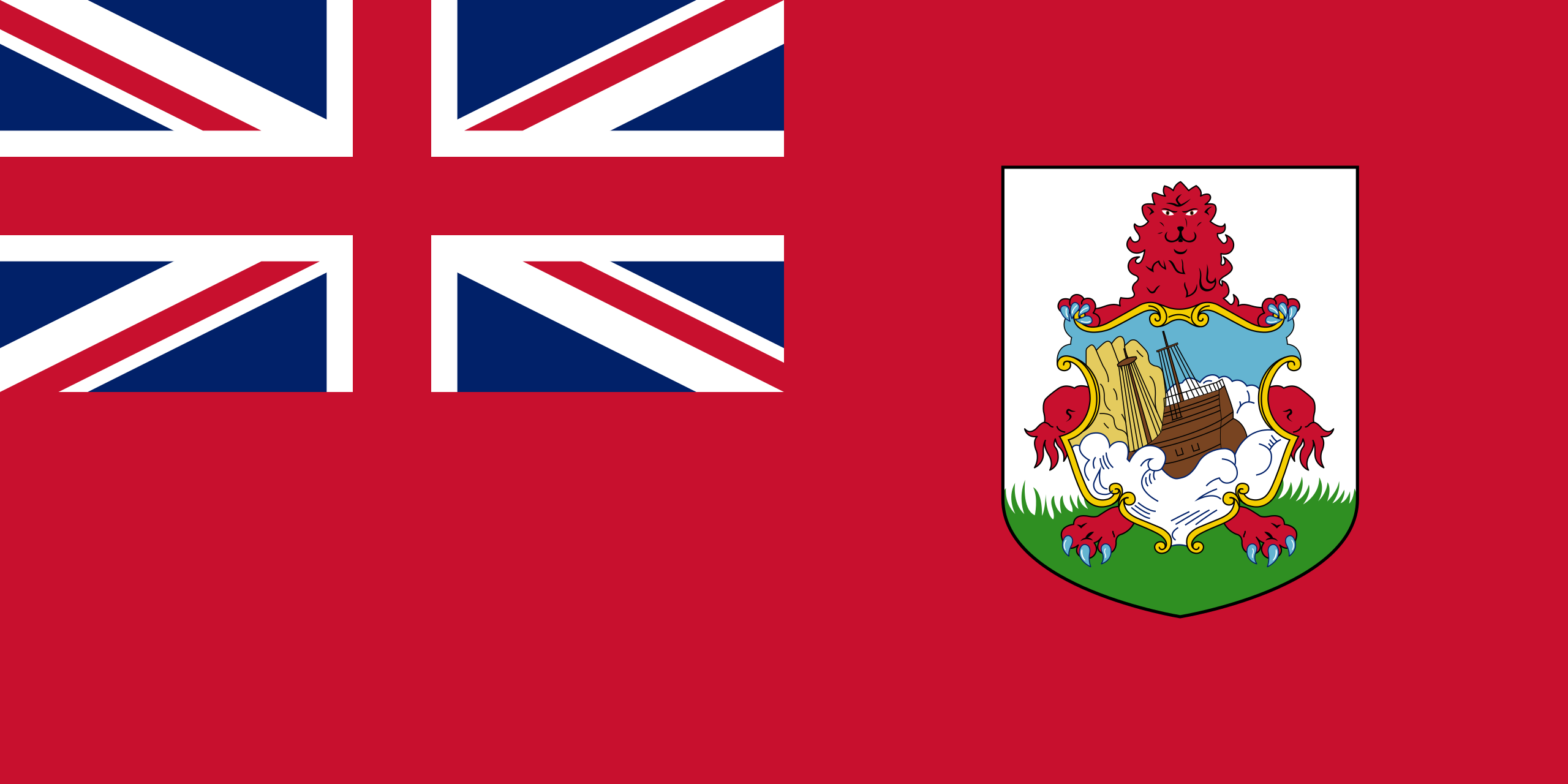

La postura progresista de las Bermudas sobre los activos digitales las ha convertido en una jurisdicción atractiva para los proveedores de servicios de valor añadido, ofreciendo un entorno favorable para las empresas de blockchain y criptomoneda. Con regulaciones claras y un compromiso con la transparencia, Bermudas proporciona una base estable y segura para que los VASP prosperen en el panorama de activos digitales en rápida evolución.

Ventajas clave:

- Reputación financiera sin parangón: Las Bermudas gozan de reconocimiento mundial como centro financiero internacional de primer orden, y figuran sistemáticamente entre las principales jurisdicciones extraterritoriales del mundo. Su reputación de integridad, transparencia y prácticas financieras sólidas proporciona a su VASP una base incomparable de confianza y credibilidad.

- Régimen fiscal atractivo: El entorno fiscal favorable de Bermudas ofrece importantes ventajas a los proveedores de servicios de valor añadido, entre las que se incluyen:

- No se aplica el impuesto de sociedades a los beneficios generados por actividades fuera de Bermudas

- No se gravan las plusvalías por la venta de activos, incluidos los virtuales

- No hay retenciones fiscales sobre dividendos, intereses o cánones pagados a no residentes.

- Normativa VASP a medida: La Ley de Negocios de Activos Digitales de Bermudas de 2018 (DABA) establece un marco regulatorio integral y con visión de futuro diseñado específicamente para VASPs. Este marco establece un equilibrio entre el fomento de la innovación y el cumplimiento de las normas más estrictas en materia de lucha contra el blanqueo de capitales y la financiación del terrorismo.

- Autoridad reguladora receptiva y solidaria: La Autoridad Monetaria de Bermudas (BMA) es el regulador designado para las actividades VASP en Bermudas. La BMA es conocida por su capacidad de respuesta, profesionalidad y compromiso de colaborar estrechamente con los titulares de licencias para garantizar el cumplimiento y facilitar el crecimiento.

- Acceso a una red mundial: La estratégica ubicación de Bermudas y su consolidada infraestructura ofrecen a los proveedores de servicios de valor añadido un acceso sin fisuras a los mercados mundiales y una variada red de instituciones financieras y socios comerciales.

Póngase en contacto con nosotros para obtener más información sobre cómo convertirse en un VASP en Bermudas